How I Broke All 3 House Flipping Rules…and What Happened

What happens when you break the 3 sacred house flipping rules? How much trouble can you get into? We reveal why and when you actually CAN do it here...

It seems like us real estate investors always want to break the rules. We’re independent rebels who are taking control of our lives and turning the status quo upside down…

It seems like us real estate investors always want to break the rules. We’re independent rebels who are taking control of our lives and turning the status quo upside down…

In fact, I seem to get at least one call per week from my previous coaching students asking me if they should break the rules of house flipping – namely The ARV Rule, The MAO Rule and The 70% Rule.

As you may know, The ARV Rule, The MAO Rule and The 70% Rule are the three most important house flipping rules you should always stick to.

The After Repair Value (or ARV Rule) is the number that you believe you can sell a house for after renovations. You get this from your real estate agent or from running comps in the area.

MAO Rule (maximum allowed offer) is the maximum amount that you should pay for a house .

And of course, The 70% Rule is what you use to make all these numbers work.

These rules work, they’ll keep you out of trouble and they will help you Continue reading

[SNEAK PEEK VIDEO] How to Buy Investment Properties Through Wholesalers

When you're buying investment properties, can you use real estate wholesalers?

Real estate wholesaling is a great way to get house flip deals...

But how about when you’re buying investment properties...should you use a wholesaler, then too?

We've talked about wholesaling so many times here as one of the best ways to find houses to flip.

At House Flipping School, we actually took on a full time wholesaler (as well as a property acquisition manager who does wholesaling) as a way to continue our deal flow for our house flips.

THAT is how important wholesaling is to our house flipping business.

But what about when you’re buying investment properties? Do you still use wholesalers the same way you would if you were doing house flips? Continue reading

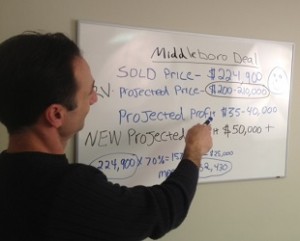

How I Broke the 70% Rule and Still Made $50,000

Once the new HFS website is launched one week from now, I will be focusing a lot more on sharing with you specific deals I have going on. I think this will further help you see and learn what the house flipping business is all about.

Once the new HFS website is launched one week from now, I will be focusing a lot more on sharing with you specific deals I have going on. I think this will further help you see and learn what the house flipping business is all about.

One of the many deals we will analyze together is a property I recently flipped and closed on in Massachusetts. This Massachusetts property is of particular interest to me, because while putting this deal together, I broke one of my most important house flipping rules.

4 Essential Steps on How to Get a Loan to Flip a House

So many people want to know how to get a loan to flip a house. It's a question I get all the time.

So many people want to know how to get a loan to flip a house. It's a question I get all the time.

Although traditional mortgages are not my preferred way to fund my flips as I prefer to flip houses with no money using private money, you can learn how to get a loan to flip a house using traditional banking.

How Do You Flip a House: The Not So Simple Truth

How do you flip a house successfully? You do it with vast knowledge of the details...

Over the past few months I have received many emails from passionate blog readers, asking how do you flip a house...but not in the typical way.

Over the past few months I have received many emails from passionate blog readers, asking how do you flip a house...but not in the typical way.

Sure, I do get a lot of emails every week asking how to flip a house with no money, how to use partners to flip houses, how to best use general contractors, how to get started flipping houses, how to wholesale and all the basic beginner questions that most people want to know.

How to Make an Offer on a House | 5 Sure-Fire Strategies

One of the most difficult things for new house flippers to master is how to make an offer on a house. Often times newbie investors will locate a great property with profit-earning potential. However they lose the property to more experienced house flippers, because they did not craft their offer in the most effective and attractive manner.

One of the most difficult things for new house flippers to master is how to make an offer on a house. Often times newbie investors will locate a great property with profit-earning potential. However they lose the property to more experienced house flippers, because they did not craft their offer in the most effective and attractive manner.

Structuring your offer for success is becoming increasingly important, because it seems like the best deals are being swept up much quicker today than just a few months ago. The market out there is highly competitive, with many investors bidding on the same properties.

3 Secrets to Nailing the After Repair Value of a House Flip

A few months ago I wrote a blog post about how to make money flipping houses entitled Do you Need to be Smarter than a 5th Grader to Flip Houses?, and I think it turned at least a couple of heads. Its true folks, you do not need a graduate degree in mathematics to make money flipping houses. All it takes to flip a house successfully is some simple multiplication, subtraction and addition.

A few months ago I wrote a blog post about how to make money flipping houses entitled Do you Need to be Smarter than a 5th Grader to Flip Houses?, and I think it turned at least a couple of heads. Its true folks, you do not need a graduate degree in mathematics to make money flipping houses. All it takes to flip a house successfully is some simple multiplication, subtraction and addition.

However it’s the numbers you use that will make or break your house flip deal. The math itself may be extremely simple. Discovering the correct numbers to use, on the other hand, requires research and help from certain experts.

By far the most important number to absolutely nail down to make money flipping houses is the ARV. The ARV is the after repair value of a house flip. Said another way, the ARV is what you expect to be able to sell the house for after renovation. Every single other projection you make will be based off the ARV. It is critical to get the ARV correct, or every single other projection will be off – and your profit margin could suffer as a result.

If you get the ARV substantially incorrect, you will be fighting an uphill battle for the rest of the house flip. To consistently make money flipping houses, you want to avoid this at all costs, and here’s how.

How to Flip Property the Creative Way

When I teach people how to flip property, I stress the importance of trusting your numbers. If you do your 5th grade math and the numbers don't work, by all means do not get aggressive with your eraser. Eraser math can get a new or seasoned house flipper into serious financial trouble.

When I teach people how to flip property, I stress the importance of trusting your numbers. If you do your 5th grade math and the numbers don't work, by all means do not get aggressive with your eraser. Eraser math can get a new or seasoned house flipper into serious financial trouble.

Calculating your after repair value, maximum allowed offer and rehab costs are essential to house flipping success. I myself still closely abide to the 70% rule for my house flips, and I don't see that changing anytime soon.

But how about those times when there is a deal on the table that feels right, however the numbers just aren't adding up. For example, lets say your projected rehab costs are so high, that the projected rehab costs alone are preventing you from getting into a deal. Is it possible to get creative, and somehow manage to flip this property for a profit?

Remember that there is no eraser math allowed!

My answer to this question is absolutely yes - it is possible to get into this deal. The only catch is that you have to be smart, and understand where and how to get creative. This is when having a well established house flipping team can really pay dividends.

Are You Ready to Build your House Flipping Team?

By far the best way to flip a house is by using a highly skilled team. Flipping a house without a house flipping team, is like trying to catch a fish without a fishing rod. You need a fishing rod to catch a fish, just like you need a team to flip a house. Best of luck trying to catch that tuna with your bare hands - and even better luck trying to flip a house by yourself.

By far the best way to flip a house is by using a highly skilled team. Flipping a house without a house flipping team, is like trying to catch a fish without a fishing rod. You need a fishing rod to catch a fish, just like you need a team to flip a house. Best of luck trying to catch that tuna with your bare hands - and even better luck trying to flip a house by yourself.

I flip houses for a living because I have a great team of people helping me out. Each week I work with:

- real estate agents

- wholesalers

- attorneys

- accountants

- insurance agents

- contractors

These people are essential team members because they specialize in areas that I am not an expert in. It would take me hours to figure out problems my team members can solve in 5 minutes. Spending time working on tasks someone else could do much easier is certainly not the best way to flip a house. Using my time efficiently is critical if I want to reach my goal of flipping 12-15 houses during 2013.

Recently I have received numerous emails from people who want to learn the best way to flip a house - which of course means learning how to build their team. These folks seem a little confused about how to build their team. Many of them have attended REIA meetings, Chambers of Commerce and other networking events without much success.

Attending these networking events is really just step 1. To be honest, it is very possible to meet your future team members outside of these networking events. I've even met valuable team members at Holiday parties, in the grocery store and on the golf course. The key is not where you meet, but instead how you handle each interaction.

How to Buy Bank Owned Property | make an offer that STICKS

Learning how to buy bank owned property is a sure-fire way to increase your odds of wholesaling and house flipping success. Entire books and courses have been developed around this topic, so to keep this post simple, I will focus on the keys to making a successful offer that sticks.

Learning how to buy bank owned property is a sure-fire way to increase your odds of wholesaling and house flipping success. Entire books and courses have been developed around this topic, so to keep this post simple, I will focus on the keys to making a successful offer that sticks.

The "Low-Down" on How to Buy Bank Owned Property

- When making an offer on a bank owned property, the first step is typically to place all offers in the name of a trust. In this instance, the trust is the buyer of the property. You the investor are the trustee, and you will execute all necessary contracts and documents. This is important to understand because here at House Flipping School we preach using OPM, or other people's money to fund your deals.

If you need a refresher on why and how to use OPM, click here.

- Once the purchase and sale agreement (P & S) has been fully executed and earnest monies accepted, the trust will have an equitable interest in the property. You will want to add your buyer to the fully executed purchase and sale agreement via an addendum. You can add your buyer as an additional trustee and/or as a beneficiary. As an investor, you have the ability to resign as a trustee and relinquish your beneficial interest. Of course all of these documents and your fee, can be held in escrow by your attorney until closing.

Are you confused yet? LOL Believe me I was the first time I read about how to buy bank owned property. Yet as with anything in life, the more times you go through this process, the more comfortable it becomes. Here at HFS.com we have a specific plan in the works for showing you exactly how to learn this sort of thing. Stay tuned this spring for some major changes here on the blog that are going to knock your socks your off.