3 Simple Ways How To Flip Houses With No Money And No Credit

Just because you're short on funds and credit, doesn’t mean you can’t learn how to flip houses with no money and no credit.

House flipping and real estate in general, is a business based in risk and money. Most people believe that, in order to get into house flipping, you must already have a substantial amount of money to invest, or at the very least, decent credit so that you will be granted a loan.

House flipping and real estate in general, is a business based in risk and money. Most people believe that, in order to get into house flipping, you must already have a substantial amount of money to invest, or at the very least, decent credit so that you will be granted a loan.

They follow the old saying “you have to spend money to make money” and hold it to be the absolute truth.

While these two aspects make the process easier, it is very possible to learn how to flip houses with no money and no credit. If you have the proper motivation and instruction, you can make money without spending a dime of your own money up front.

Below are a few basic examples of easy ways to get into the business without money or credit.

How to Flip Houses With No Money and No Credit: 3 Ideas

While it is possible to start a house flipping project without your own money, the money does have to come from somewhere. A popular approach to this problem is “OPM” or other people’s money. To learn how to flip houses with no money and no credit, there are many ways to approach it, but these three below are the most popular by far.

Believe it or not, there always other people in the world looking to invest what money they have into projects that they feel could be successful. There are a number of different types of investors and ways to approach investing like partnership, private investors, and hard money. We outline them here:

1. Partnerships

A partnership refers to the process in which two people combine forces to tackle a housing project. One of the partners will pay for the initial costs of the home and any improvements that are to be made before the property is resold. The other partner (you), will be in charge of the rest of the logistical responsibilities of flipping the house like hiring contractors to do renovations, or doing them yourself.

In turn, each partner will receive fifty percent of the end profit. Because you will be giving up half of your final profit, this perhaps should be considered as a last resort option if you cannot find another type of investor.

Although there are thousands of ways to structure a partnership in house flipping, this is one of the most common ways. Be creative and figure out a partnership strategy that's right for you.

2. Private Investors

A private investor is a person, who is not associated with any particular bank or business, willing to invest on your project. Finding a private investor may be as easy as looking close to home. People like friends and family; from co-workers to fellow churchgoers to members of your local chamber of commerce to your family dentist can all act as private investors. They are essentially people with disposable incoming looking to make a good return on their investments.

3. Hard Money Lenders

Like banks, hard money lenders will loan you out a sum of money expecting you to later repay the amount plus interest. Unlike banks however, these lenders do not typically regard things like the borrower’s assets, income or credit score. This means that if you are a person with no money and no credit score, hard money lenders are still eager to loan you money.

In addition to the interest they charge you, they will also charge you what are called “points”. One point equals one percent of the loan they gave you. Typically, hard money lenders will charge you somewhere between five and six points on each loan.

While the interest rate money from the points might seem costly, if you calculate these numbers into your business plan you will know whether or not it is worth while. If you subtract the original price of the property, the expense of the expected repairs, and the money you will owe the hard money lenders from the expected value of the property after the repairs, and you’re still in the positive, then the loan should be worth while.

Instead of basing whether or not they will loan you money on your financial history and ability to pay the money back, these lenders use the property you wish to flip as collateral. Because of this collateral system, these hard money lenders can be risky to deal with. However, if you have a guided and well thought out business plan, you shouldn’t run into any trouble paying back the loans.

Why You Shouldn’t Worry If You’re Flipping Houses With No Money And No Credit

The word “credit” comes from the latin word “credo” meaning “I believe”. Often times when people have no credit, they think that the world doesn’t believe in them, and that they will not pay back their loan. However, if you have a well thought out, well-managed business plan, you can successfully borrow money and later pay it back, while also earning some profit for yourself.

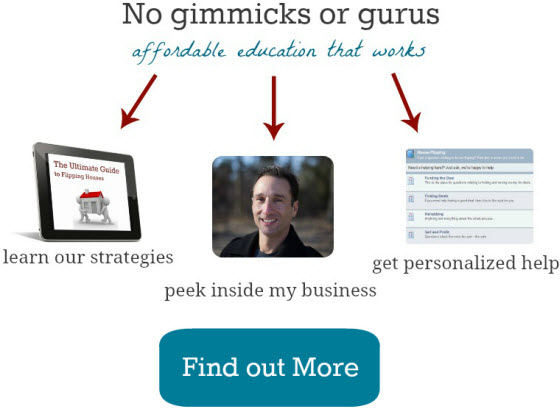

Like this post? Consider becoming a House Flipping School member and round out your house flipping education. Click here to see what it's all about.

Hi,

I’m very interested in flipping homes. I had a California real estate license but bc the market was so slow I didn’t pay the dues and lost it. I really don’t have money or credit but really want to flip homes.

My question is how do I get started? What is the first step? I live in Ventura county near los Angeles county in Thousand Oaks.

Thank you.

Hi Erin! I feel the Home Study would be terrific for helping you get started https://houseflippingschool.com/action

I’ve been trying to find a good way to flip a home, even though I don’t have that much money or credit. It makes sense that I would want to find a partnership and a lender! I’ll start looking.

Good thinking Braden, consider check out a REIA networking event in your area > http://nationalreia.org/find-a-reia/

Hello,

I am interested in flipping homes,but I need to know how to get started? And were to begin. I don’t have money or excellent credit but they say you can flip homes with no credit or no money were do I need to begin. Also, I read about having a partnership which would be great thing.

Hi Denise!

A great place to start and get answers to the questions you are asking, is by downloading our “Tool Kit” and accompanying study materials > https://houseflippingschool.com/tool-kit/

Check it out when you can and let us know.

Hello,

I am interested in flipping homes,I renovate,repair the contractor side of business for flippers now but I need to know how to get started? And were to begin. I don’t have money or excellent credit but 2 people i contract for they say you can flip homes with no credit or no money were do I need to begin. Like I mentioned I do the Contractor side of it now but don’t know the investor part.

The biggest challenge for most newbie investors is to arrange for capital. Partnership, hard money lenders and investors are a great way to raise capital. I personally prefer partnership model.