5 Little Known Ways to Finance Your Next House Flip

This guest blog post is written by Jimmy Moncrief of realestatefinancehq.com

I’m a credit officer (read: underwriting) at a bank so I am naturally skeptical when loan officers pitch me their customers who flip houses. However, over the years I have seen people who have literally had nothing to a million dollar net worth, purely from flipping houses.

I’m a credit officer (read: underwriting) at a bank so I am naturally skeptical when loan officers pitch me their customers who flip houses. However, over the years I have seen people who have literally had nothing to a million dollar net worth, purely from flipping houses.

House Flipping School does a great job on educating you how to flip - especially on how to flip houses with no money. My skill-set isn’t house flipping, it’s financing so that is what I’m going to focus on - namely some other methods on how to finance a house flip - whether its your first or your hundred and first.

How to Finance a House Flip - Things to Consider

It is very rare for full-time real estate flippers to only do one deal at a time. If they are doing their bookkeeping and have a strong way to stay ahead of their finances, then they should be able to juggle multiple deals. Additionally, the very successful home flippers want to do more deals because the more deals they do the more money they make.

However, there is one small caveat. The more deals you are involved in, your company and personal cash dries-up due to all your cash being in the deals you are currently working on. This not only causes stress in your business, but also limits you in future deals.

Lenders always want to match the maturity of the loan with the repayment strategy. Since all flippers I know want to be in and out of the house within one year, I focused on those loan options.

I know everyone always wants the lowest interest rate. I agree this is very important. However, I also want you to think about the time value of money. What do I mean by this?

If you can acquire a property 1 month faster and pay a 100 basis point (1%) premium, it’s probably worth it. Let’s go over the math:

- Loan Amount: $100,000

- 6% - $500.00 monthly interest

- 7% - $583.33 monthly interest

- Time from purchase to sale = 3 months

- Profit from Flip = $20,000

In the example above, if the 7% lender acted 1 month faster than the 6% lender you only paid $83.33 to make $20,000 one month sooner. Because you did the deal quickly, you can now do more deals.

A lot of real estate investors lose sight of the forest for the trees. They are so worried about finding the lowest interest rate, they forget about how much money they could have already made if they closed on their deal.

1. Home Equity Line of Credit

Although this is not recommended as a first line strategy, this one method I have seen home flippers use. It is risky and you can get yourself into trouble if you are not careful and don't follow the house flipping rules Mike lays out here in House Flipping School.

The interest rate is usually very attractive and the line amount usually corresponds to a borrowing capacity that is within your risk-tolerance.

Note, the big banks have VERY low interest rates. I have seen cases where HELOCs are priced at 2%. The reason big banks do this is so they can get your other business. HELOCs are the only product I recommend going to a big bank for because the price is usally worth going through their long procedures.

2. Investors

There have been many books and blog posts written about getting private investors to fund your real estate investing. Therefore, I’m not going to attempt to cover everything in this guest blog post. The cheapest option for house flippers is simply to draw the money up-front and pay interest only. The lowest rate I have seen is 2%. The reason the investor got that low of rate was that it was family and they simply stated that 2% was far higher than the 0.02% they were getting in their savings account.

A normal interest rate is around 5-8%. However, I have personally seen investors pay 12% plus 20% of the profit.

Another case is where I have seen investors pay no interest but the person loaning the money gets 50% of the profit.

3. Officer Guidance Line

This is a rare product that investors rarely use, simply because they don’t know about it. Large home-builders use this product a lot.

If a builder comes to a bank and qualifies to build five houses a year (up to a $1,000,000 total exposure), and the bank has pre-approved lending on all five houses the bank will give the builder an official guidance line.

What this does is give the builder a peace of mind and know that he already has funding for 5 houses and doesn’t have to reapply for every single home being built.

This saves everyone a significant amount of time. Importantly, the officer guidance line still has to meet normal collateral rules (80% LTV, etc). Additionally, the loan officer approves any withdraw requests.

Flippers can (and do) use this same product that most builders do. Community banks and credit unions usually offer this the most. The price is usually very competitive as well.

4. Portfolio Line of Credit

This works great if you have several properties that are paid-off, or have substantial equity. The bank can take a lien on all of the properties and give you a line of credit based on the collateral. This gives you significant flexibility in buying properties.

As you know there is a significant advantage if you can buy properties quickly and with “cash.” This strategy allows this.

5. Retirement Account

Borrowing from a 401K and/or IRA is heresy to most people. Once again, this is not recommended as a first line strategy, as there are some severe consequences if you don’t pay the money back within the agreed upon time. So do this one at your own risk - unless you do this with the help of a financial professional using a self-directed IRA.

The biggest negative is that it is taxed and accrues several punitive fee’s if not paid back in a short-time period. However, you are a flipper – you plan on paying back the loan anyway.

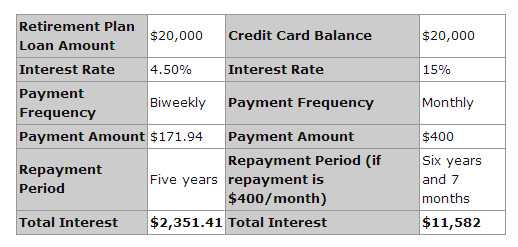

Let’s compare using credit cards to using a retirement account to fund your flip:

As you can see borrowing from your retirement account is significantly cheaper.

The other main advantages are as follows:

- Repayment is easy because the payments are usually taken out of your paycheck.

- They are easy to qualify for because you are borrowing from yourself.

- You can get the money very quickly.

- Interest rates are lower than other sources: credit cards, hard money loans, etc.

How to Finance a House Flip Summary

In summary, have a goal of outlining multiple funding sources for your flips. Real Estate is a capital-intensive business. The barrier to capital is what keeps the profit-margins so high. Therefore if you have multiple sources of funding you will have a competitive advantage versus your peers.

Jimmy Moncrief is a bank underwriter and real estate investor. He blogs at realestatefinancehq.com and has a special report exclusive for House Flipping School readers. Get it here

Trying to decide if this is a good investment option.

Hi Debbie

Can you be more specific with your question.

Great article Mike! Financing decisions should always be done after careful evaluation of risk tolerance and future contingencies. Many investors prefer hard loans at first, to get out of the long waiting times of bank approvals. What people should understand that flipping houses is not an investment for future financial goals. It is rather a culmination of speculation and project management skills.