How to Secure Funding for your First House Flip Deal

If you've been following this blog for a little while then you probably understand that learning how to flip a house is not for everyone. You really need to have the right kind of motivation, mindset and passion to get into this business.

As with anything there are many challenges and hurdles to overcome when you are new to the real estate investing business. Believe me when I say that these challenges are very conquerable, yet they are challenges nonetheless.

One of the most daunting tasks for many newbie house flippers who want to learn how to flip a house is getting that very first deal together. Quite a bit of work and preparation goes into making that first deal happen. I should know, it was not that long ago that I myself was sweating over my very first house flip deal!

An important part of any deal is funding. This is especially true when you are just starting out, because often times you may not have enough money of your own to fund a deal so they need to learn how to flip a house with no money. Many new to the business house flippers struggle with how to approach an investor and ask for money, when they really have no experience and lack a long track history of successful house flips.

Which leads to the question...should you fake it until you make it?

How to Flip a House | Approaching Investors

In certain businesses you may be able to get away with "faking it until you make it" - however real estate is not such a business.

I think it is best to be very honest and transparent when you approach a potential investor. In my opinion there is nothing wrong with telling an investor that this is your first house flip deal.

If you do tell them that this is your first deal (which I highly recommend) then you must be prepared to convey how serious you are about the deal. Consider putting together an investor presentation highlighting topics such as the ARV (after repair value), soft costs and projections. Explain the 70% rule and show them how you expect the deal to work.

If you want to stay in this business for the long term, then always be honest. Stretching the truth and not being 100% transparent with regards to your current level of real estate experience will often times come back to nip you in the butt sometime down the road.

How to Flip a House with No Money of Your Own | Working with a Mentor

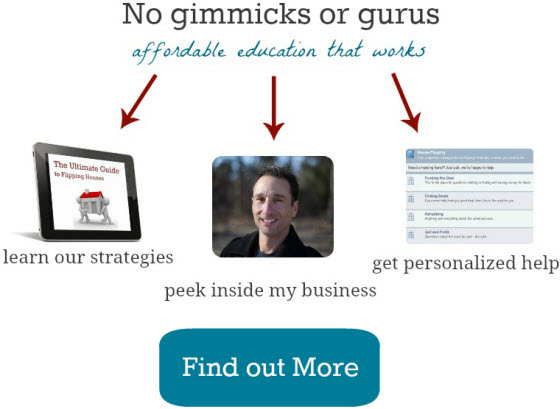

In addition to being honest I also recommend seeking out the guidance of a more experienced real estate mentor or real estate coach. This person could be a friend that you meet through a REIA meeting or a even a paid coach.

Actually, it could even be me!

Having an experienced and successful real estate investor by your side is added "ammo" when presenting to potential investors. You can tell the investor that you are working side by side with someone who knows how to flip a house and has dozens of successful deals under their belt.

This added "ammo" is oftentimes all it takes to convince an investor that lending you money for your house flip is a smart decision.

As always thanks for checking out the blog - I really appreciate it.

We have also just launched a new House Flipping School Facebook page that I would love for you to become a part of. We have a really nice community coming together here on the blog, and I am planning on developing the same type of community via Facebook over the coming months.

Thanks again and see you at the top!

Mike

I want to flip one house a year . I have no credit , no money, and no

Knowledge. I would like to just flip a house a year and that’s all to get xtra income to make life a little easier. Hopefully proffitt 40,000 or more. Is this possible with a mentor .

You can do it brother. Here’s a great way to get started: https://houseflippingschool.com/blog/how-to-flip-houses-with-no-money/

Id suggest you get the ebook as well. Just drop your email into the box on the righthand side of the blog. Mike

I WOULD LIKE TO FLIP HOUSES FOR A PROFIT. I HAVE NO EXPERIENCE YET I HAVE

BOUGHT AND SOLD LAND BEFORE AS WELL AS BUILT A HOUSE.

Hello Stephen – If you have the desire you can do it. With your experience with land & building a home you have some experience & with your knowledge on land purchases that could be an advantage for you. Did you get my ebook and read it yet? Let me know.

Where you from & looking to flip.

My wife and I are very interested in flipping houses for a living but have no experience. How hard is it to get started with no cash to invest upfront?

Hey Scott – It is a process like any business. I would suggest you read my ebook and continue to go through my website. I just created a new site where you can check it out for $1 & then just under $15 a months after that where I go into great detail on many of those questions and fears new investors face. How hard is it you ask?

If you’re motivated and willing to put the effort in then you can achieve it. I will never tell anyone it is hit the easy button because it is not. Love to have you on board with the new site. You won’t be disappointed.

Hi Mike

hanks for a very interesting article. I live and trade in South Africa and wonder how things differ here from the USA where you operate?

Our transfer costs are approximately 5% ( transfer tax) and then sales commission to be paid to the realtor is a further 7 or 8%

Sales commission we usual pay around 5%. Make sure you carry for that hefty transfer tax.

Transfer taxes vary from state to state. Here it is around .5%.

Well just read the “free” book you offered. I got it quick. Not what Iam looking for. Iam a little more experienced the the beginner. I was and still am looking for funding and not at the hard lender rates lol

You need to work private money Scott or negotiate with hard money rates which may be difficult if you don’t have experience. You can also work with banks if you have good credit and consider partnering as well. Many options.

Hello Mike,

I have always been interested in Real Estate, I actually am thinking of getting my License. But I am also interested in flipping houses. I am a very organized, motivated person. I want to work for myself which is why I thought flipping may be better for me. It may be good if I still got my license so I can sell my own flips. Any way, I may have an option for an investor and I have done other research, I know the market in my area, I am constantly looking what is out there and looking at the comps. But I am afraid that I will miss something in terms of the planning and the financial side of it. Are there any documents that you have available to help asses every aspect of purchase and renovation to get the best profit?

Hi Heather! Congratulations on all your movement in the right direction. Sounds awesome!

We have several documents in our Toolkit which may help. You can check them out here if you’d like https://houseflippingschool.com/tool-kit/#forms

Based on your comment I feel the Property Check Sheet or Project Repair Estimate sheet might be most helpful. However keep in mind these are “tools” to help you and not the end all be all.

Definitely best to develop a team of experts who work in your area, who you can bounce ideas and questions off. Keep us posted!

Found our first house to flip. Had an interested investor but she backed out becuase she felt like everything was moving to quickly. Ummm, now how to get the money to flip this house???

Hi Diana!

Check out Module #4 “Secure the Funding” > https://houseflippingschool.com/tool-kit/

Hello,

I have a client that is liquidating their real estate properties. I do Legal, Public Relations and Crisis management, so this is not my field of expertise. Where would I go about finding cash buyers for their properties?

Hey Tara, personally I am not a real estate expert, but I just wanted to let you know that finding buyers is covered in Module 7 of Mike’s Tool Kit > https://houseflippingschool.com/tool-kit/

Great